This text used to be co-written through Charlotte Beck of the Agence française de développement (AFD).

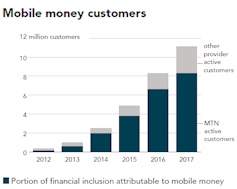

Lately, the unheard of enlargement of cellular economic amenities in sub-Saharan Africa has defied expectancies. Whilst Kenya is steadily cited as a number one instance of electronic transformation, Ghana has just lately transform the fastest-growing cellular cash marketplace in Africa, with registered accounts expanding six-fold between 2012 and 2017. The rustic’s enjoy supplies a contemporary standpoint on its electronic transformation and demonstrates that generation can assist modernise the economic machine in addition to additionally make stronger better economic inclusion.

CGAP Center of attention Observe 110 2018, Writer supplied

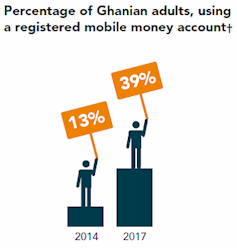

In Ghana, cellular economic amenities are most commonly utilized by the ones poorly served through the standard economic sector. The 2017 World Findex database signifies that get right of entry to to formal economic amenities rose from 41% of adults in 2014 to 58% in 2017. That is in large part resulting from cellular accounts, with 20% of digital-wallet customers being in the past unbanked. Those now constitute about 40% of all account holders, in comparison to 13% in 2014.

Moreover, through decreasing the lengths of transactions in addition to the related dangers and prices, mobile-money answers higher meet the desires of prone shoppers equivalent to smallholder farmers. Whilst rural get right of entry to to formal economic accounts continues to be low, figures have virtually doubled since 2011, from 26% to 51%. Lately, roughly 40% of bills for the sale of agricultural merchandise are made by way of a proper account, and typically right into a mobile-money account.

Contents

Cell cash on the upward push

CGAP Center of attention Observe 110 2018

Many components provide an explanation for the speedy growth of cellular cash use in Ghana. First, the sturdy penetration charge of cell phones (about 128% of the inhabitants) make the common use of mobile-money amenities imaginable, in particular in rural spaces. 2nd, and extra importantly, the Ghanaian luck is the made of a right combination of consumer-driven practices and a beneficial regulatory surroundings for the trade, constructed at the again of early infrastructure investments.

If Ghana can boast about championing cellular cash these days, within the early years electronic amenities struggled to achieve traction. The preliminary 2008 law for branchless banking used to be extremely restrictive, enforcing regulations and necessities that deterred maximum tasks. The laws mirrored the perceived “high-risk gamble” of permitting non-bank actors equivalent to cellular community operators to factor e-money and doable unfavorable implications for the balance of Ghana’s banking sector.

When it was obvious that adoption used to be falling neatly beneath expectancies, with the make stronger of the Consultative Staff to Lend a hand the Deficient (CGAP), the Financial institution of Ghana agreed to interact with all stakeholders and take a 2nd take a look at the laws to switch the process cellular cash within the nation. The revised 2015 e-Cash Issuer Tips shifted to a extra versatile manner, permitting new gamers within the provision of economic amenities and extra scope for experimentation.

Key tasks

Along with making a regulatory framework tailored to the desires of customers and operators, Ghanaian government took different key tasks in supporting the advance of cutting edge cost applied sciences. Underlined in the newest International Financial institution financial replace, the growth of the agent distribution community – from round 6,000 brokers in 2012 to greater than 150,000 in 2015 – used to be key to permit extra cash-in and cash-out alternatives and general comfort of the use of cellular cash.

In Would possibly 2018 Ghana additionally introduced some of the first interoperable methods in Africa, permitting transactions between the other carrier suppliers. Interoperability bills reached 308 million GHS (57 million US bucks) through the top of March 2019. In any case, the advent of the E-zwich biometric card will have to ease reputation and use of bills answers for all cardholders.

Consumer adoption of cellular banking is expanding, however has been restricted through limited service provider acceptance: 2.7 million playing cards had been issued and seven.7 million transactions treated, representing 2% of Ghana’s GDP. Despite the fact that maximum bills are right away cashed out, 53% have residual price.

Ghanaians have thus far used cellular wallets mainly for moving cash to an individual (peer-to-peer, P2P). In step with Financial institution of Ghana knowledge, the overall price of all cellular cash transactions reached 156 billion GHS (29 billion US bucks) in 2017, in comparison to 35 billion GHS (6.5 billion US bucks) in 2015. Regularly the variety of cellular available items and amenities has effectively expanded to the acquisition of cellular communique credit, cost of public carrier expenses or salaries.

Subsequent step, government-to-people

To reach sustainable trade, Ghana’s subsequent problem revolves round digitizing authorities collections and software bills – government-to-people (G2P) and vice versa – nearly all of which continues to be paid in coins. Digitizing those bills will assist increase the tax base, build up the scale of the formal financial system, as neatly make stronger economic inclusion efforts.

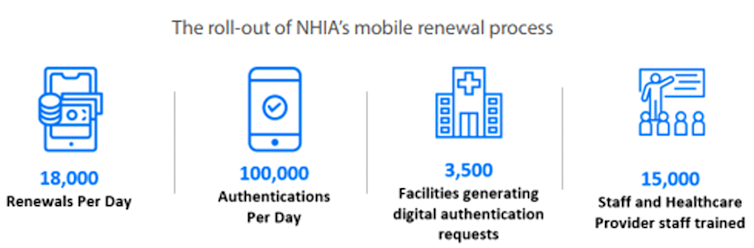

A captivating instance is the electronic renewal strategy of Ghana’s Nationwide Well being Insurance coverage Authority (NHIA), whose position is to make sure get right of entry to to elementary healthcare amenities for all citizens.

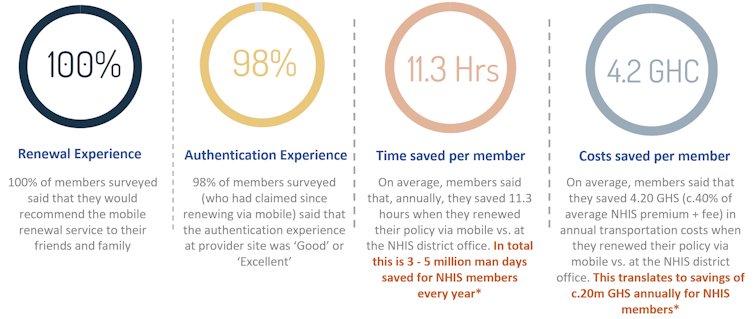

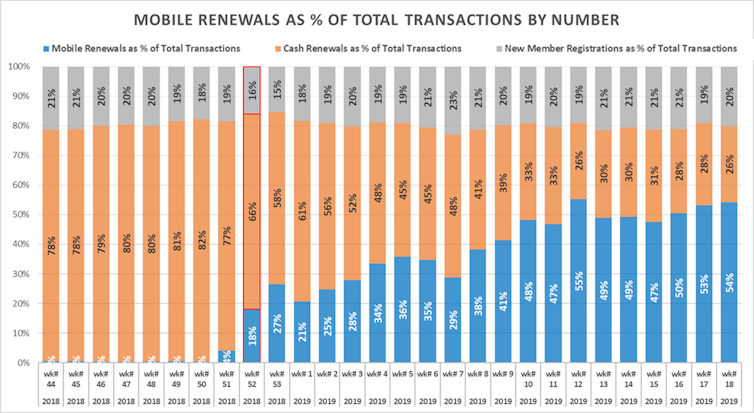

On the finish of 2018 the machine had roughly 11 million participants who have been required to resume their club in particular person at a district administrative center. The method used to be time eating, from time to time taking as much as 11 hours, and slowed the expansion in protection, which had levelled off at round 40% of the inhabitants. Supported through the Affect Insurance coverage Facility of the Global Labour Organisation and the Agence française de développement (AFD), a user-friendly platform now lets in Ghanaians to resume their club by way of a cell phone. The use of design considering, the purpose used to be to make sure that the generation would in reality succeed in goal communities with easy messages and an interface that may be simple to grasp.

Nationwide Well being Insurance coverage Authority’s electronic renewal procedure

Nationwide Well being Insurance coverage Authority’s electronic renewal procedure

As with different such tasks, the Nationwide Well being Insurance coverage programme faces quite a few demanding situations. Then again, the applying of generation has helped to cope with one of the crucial logistical problems round renewal. Lately, 54% renewals now happen the use of cell phones, decreasing the queues at district workplaces for many who renew in particular person at district workplaces.

Affect Insurance coverage Facility

The opposite sides of digitisation come with verifying member identification at healthcare suppliers, claims authorisation, and in addition notify customers when claims are being made of their title, serving to flag doable fraud. Expanding electronic renewals and authentication is predicted to each build up income and reduce prices, doubtlessly resulting in an estimated 15-25% relief in NHIA’s annual deficit.

The luck and sustainability of the initiative will rely the facility to extend utilization in rural spaces and amongst staff within the casual financial system. As indicated within the March 2019 learn about, “Determinants of paying nationwide medical insurance top class with cell phone in Ghana”, “making the method as user-friendly and so simple as imaginable may inspire many that in a different way would now not take part to take action”.

Enabling innovation

Ghana supplies a singular case of governmental dedication to create an acceptable operating surroundings for innovation. Virtual answers have enabled wider get right of entry to to economic amenities equivalent to medical insurance, mobile-based pension schemes (see Other people’ Pension Accept as true with) and microcredit loans. An increasing number of in the past unbanked customers at the moment are the use of micro-loan amenities (beginning at 2 US bucks). For the primary time, customers will even earn pastime on their electronic saving accounts, with overall pastime paid to holders of digital cash wallets amounting to 24.8 million GHS (4.5 million US bucks) in 2016.

Then again, in an atmosphere of low economic literacy, a lot of the ones the use of electronic credit score merchandise don’t absolutely figuring out their rights and tasks as shoppers, and from time to time fall sufferer to predatory practices. Going ahead, the Ghanaian consumer-protection law should take on client-protection problems raised through electronic economic amenities, in keeping with Social Efficiency Job Pressure suggestions, supported through AFD.

Supply Through https://theconversation.com/how-ghana-is-acing-its-transition-to-mobile-financial-services-119625